Ever find yourself with a sick feeling the whole day owing to the disarray in your finances? You know you are in debt. And, not just some but a lot. It just feels like there is no end to debt in life. It feels like you’re going to be in debt forever. That’s where the debt repayment plan will be your savior!

The never ending bills just pile up in front of your eyes. You feel that there won’t be enough money anytime for anything in life. Dreaming of complete debt payoff may seem fully unthinkable.

Does it exactly sound like your situation? Then, worry not, because you are about to form a strong habit and tackle your debt soon. You just need to commit to a debt repayment plan.

You made some bad financial decisions in the past, but now is the time to change your fate and future. Paying off debt is an overriding thought in your head.

Perhaps, you have to pay off a whopping debt to a card company or an individual, but you do not have a concrete plan as to how you will do that. As great financial planners, we have a solution for you. Invest your time to learn how to create a debt repayment plan.

Why Do You Need A Debt Repayment Plan?

One hundred worries in your mind will not pay an ounce of debt. Take action now.

We do not wish to confuse you with technical jargon, but debt repayment plan concept can refer to many things.

Is this just another million-dollar question to ask yourself and form a plan? Well, yes, your guess is right.

You may want to attack your debt aggressively with two mindset

- To pay off the debt at a faster rate.

- Pay the lowest interest charges.

More importantly, you want to lead a stress-free life. Always remember that once you are gone from the world, the responsibility of paying off your debt goes straight to your dependents.

Here’s an elaborate post that talks about a payment plan to pay off debt.

Moreover, look out for a basic debt repayment plan worksheet printable that you can print and use later. Let’s dive right into the details.

What Is A Debt Repayment Plan?

In Layman’s terms, a debt repayment plan means to pay yourself personally. You need to set it up and work on it diligently to eradicate debt. Anybody who has to pay off a particular type of debt will enroll in the debt settlement payment plan.

As we move forward, it is essential to know about the different debt repayment plans for various types of debt you can incur.

- Tax debt: The IRS tax repayment plan is basically between you and the IRS. The plan can be set up via the IRS website. In case you have to pay more than $10,000, the tax debt will be more complex. In this case, you would need a tax resolution whiz.

- Student loan debt: For the best payment plan for student loans, you need to keep specific pointers in your head. In the case of federal loans, there are a total of 7 plans to look at. These include standard, graduated, income-based, income-contingent, pay as you earn, income-sensitive, and revised-pay-as-you-earn. If you wish to lower the payments, then the extended repayment plan works well.

- Credit card debt: Credit card payoff plan is something you can make on your own. If not, you can also opt for the debt management program. To pay off this debt, you need to speak to the creditors about the best way to reach ‘0’ on each balance.

What Do You Write In A Debt Repayment Plan?

You would need to jot down the debt you owe. Write the creditor’s name, current balance, and APR.

Then, the next step is to make a call to each of the creditors. Is there any scope for negotiation? There sure is!

If you are a long-term customer, the creditor will be happy to negotiate.

If you have missed payments before, it will be a tough call. In case the creditor agrees for adjustment, you would need to freeze the account.

The debt management program enters the scene when you need expert financial advice on the best repayment plan. Try taking a credit counseling to help you with actionable information. This will help you apply a strategic plan to apply on the credit card debt repayment plan wisely.

Debt Repayment Plan Advantages

The primary advantage of debt repayment plan is you’ll always have some fixed amount going towards debt every month. You first need to commit to debt payment each month and then think how to plan a budget around it. Finishing this important step will make your finances completely easy to manage.

Secondly, by following a formal plan with a clear strategy, you are working towards making your situation better quickly. By doing this, you will pay off debts responsibly and quickly. You will work on continuously minimizing the outstanding debt amount you owe.

Just have a clear thought process and action plan by month on the execution of your debt attack plan. Once you have a plan and the motivation to finish the task, then it becomes easy to achieve.

But, remember debt doesn’t disappear in a week or month. You need to put in efforts for months together to make it work. Having a debt repayment plan comes in handy for those who struggle to figure out the solution on how to repay debt quickly.

Debt repayment plan also indirectly helps on how to budget your life around it. These advantages from a simple debt plan is a game changer.

How To Create A Debt Repayment Plan

Creating a debt repayment plan to pay off the credit card bills is easy. You can create the payment plan on an excel sheet, or you could use the application available on your mobile device.

There are different methods involved. We will see two main methods in this post and create a separate one to cover all methods later.

- Firstly, there is a debt snowball method. In this, you pay the smallest debts first. This method will give you psychological satisfaction that you have cleared all small debts.

- Secondly, there is debt avalanche method. This is another method where you pay off debt with the highest interest rate. This will allow you to save some money by not paying excessive interest.

Once you create this plan, you need to think of ways to increase your income that you can then put towards debt repayment.

Taking up a part-time job or a freelance job would do. Rent out an apartment or find small business ideas. There are plenty of things to do in the world! You can start taking out 2-3 hours in a day tutoring on a subject you like.

Basically, the idea is to find ways to generate extra income. This way, you will be able to pay off the pending debt easily.

A debt repayment planner will make the process of creating a debt repayment plan much easier. There are lots of tools available online. Where? Let’s find out.

Debt Payoff Plan App

Surprisingly, there is a debt payoff plan app for all those who do not wish to start from scratch.

These are available on either iOS or Android. Here’s a list of the apps you can take advantage of.

- Debt Manager

- Debt-free

- Debt Payoff Assistant

- The Debt Tracker

- Debt Strategy

Some of these apps are free to use, and in some, you might need to incur small charges of 99 cents.

There are two methods used – the debt avalanche method and the debt snowball method.

These apps will give you access to both the methods or either of them.

The applications are great solely because they allow you to manage your finances efficiently. Moreover, these will help in building up a strategy that is best for your current situation.

These will give you an exact idea of how much time it will take to pay off the remaining debts. Basically, all the financial details will be at your fingertips.

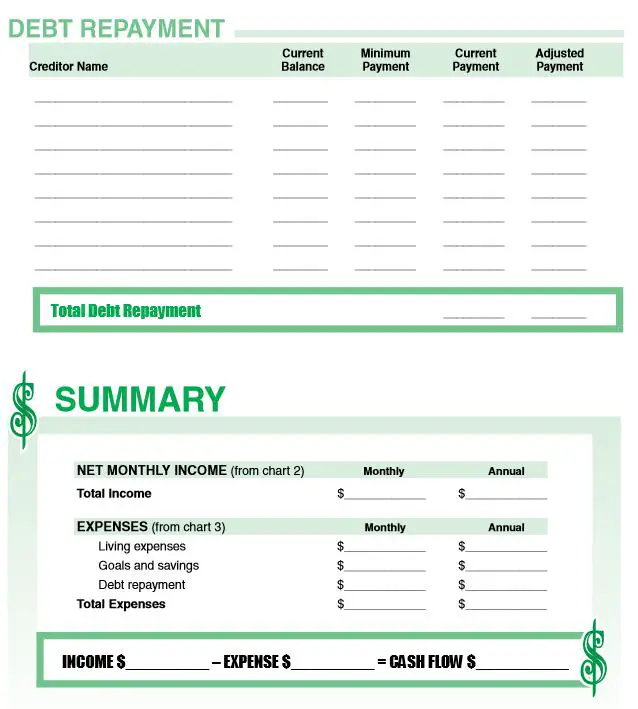

Debt Repayment Plan Worksheet

You can either work on Excel or create something real quick as the one below

Basically, you need to add the following things in the Excel sheet:

- A list of pending debts. Write the creditor’s name and the type of debt

- You would also need to list the APRs for each debt

- Rank these debts on priority-basis (also deadline)

- Debts have their own balances. Write down the balance of each

- What is the monthly minimum payment for each debt?

- You also need to write down monthly expenses and the total income

- How much money you intend to keep to pay off debts?

All this information is important and needs to be added to the worksheet.

5 Steps To Make A Solid Debt Payment Plan

Watch list of all debts

This is the easiest part. You just need to be honest with yourself and go through all your debt and form a complete list. If you’re old school, just go with pen and paper. I’m a data analyst by profession and prefer everything in digital format to analyze later. So, Dropbox Paper with Office Online spreadsheet or Google Docs works wonderful for me.

For every debt you own, include debt category or description, like mortgage and Chase Sapphire Reserve card. Then, record the debt balance, annual percentage rate (APR) and monthly minimum payment.

The easiest way to record all debt is to go through all information from the original debt document or recent statement. If you can not find the information, call the number at the back of your credit card for credit card revolving debt. For debt, just call up the lender and ask.

Refinance Interest On Debt

Identifying opportunities to minimize interest rate is the next obvious step. For instance, you may want to consolidate student loans to further refinance into a low interest rate loan.

Not just student debt, you may want to see if you can refinance mortgage. Then, you may want to have balance transfer credit cards to lower interest rate or pay 0% interest with 0 balance transfer fee and 0% balance transfer interest rate cards.

CryptoandFire pro tip is to not concentrate too much on the zero introductory rate or lower introductory APR in credit cards. The only rate that heavily matters is Annual Percentage Rate (APR) that you’ll pay, if not paid on time within the introductory period.

For instance, when you are lured with 0% introductory APR when you try to balance transfer, look at what the non-introductory rate which will above 20% for sure. Then, just think the actual credit card interest rate is 33%.

Repeat the same process for all debts.Focus on strategic moves to lower your debt interest rate. This way, you will lower monthly payments and get out of the debt situation quickly.

Organize Debt

Once there is not more opportunity to reduce interest rate further, the next step is to organize debt. You will want to order the complete list of debt you owe in some way that is easily interpret-able.

Snowball vs avalanche debt method is the talk of the town to tackle debt. If you ask my personal opinion, I will go with Debt Avalanche method any day.

Avalanche method concentrates on organizing debt by APR with the decreasing order of their interest rate. This will help you pay lowest amount in interest. But, it may take some time to finish off your first debt if it is lower than APR than others.

Debt snowball helps you organize debts in the increasing order of their outstanding balance. So, the smallest debt balance comes to the top. If you have a lot of different debt, closing one or two accounts with small balance faster may give you peace of mind. As a result, you pay off the 1st debt incurred as soon as possible. Debt payment success is a totally separate feeling that everyone needs to go through to understand.

Calculate The Amount Of Debt To Tackle Every Month

And Now, add all minimum payments from all debts. This is what you owe in absolute minimum of debt, come what may. If you only make minimum payment every month, don’t expect to pay debt off quickly. But, you’ll get that done with the plan.

CryptoandFire pro tip : Embrace minimalism while in debt and take an aggressive stance on finishing the debt.

Then, make your mind on the extra money you want to commit to debt payment apart from the minimum debt payment. For instance, just rounding in thousands forward will make it easier to remember and also help pay-off debt faster. If your minimum debt payment comes up towards $2150, then aim higher for $3,000 per month repayment. If the debt is $725, then go for $1000 per month.

After that, you will see your budget change to accommodate the higher debt payment.

Pay Debt Down

Now that we have formed the strategy, the final smart step involves actually wipe those debts off your life. Make minimum payment for sure on all debts.

Then, take what you have left after your monthly basic necessities and apply to top most debt, basis avalanche vs snowball method. When one of the debt at the top is paid, just remove it from your list and repeat the process. Enjoy small wins along the way to make the journey enjoyable!

CryptoandFire pro tip is not to make lower payments on the existing debt. Instead, continue to pay the same amount as you paid before. This way, your extra payment keeps increasing and closes your further debts faster.

Eventually, the last debt you tackle will be the easiest and fastest to tackle because of incredibly huge payments.

Remember, the most important thing while you’re clearing your debt is not to rack up further debt. Otherwise, it is a leaky bucket situation. Try to avoid charging credit cards if you think you may not be a responsible adult.

The final step is to actually save even after tackling all debt and not finance any purchase further, even large ones.

Debt Repayment Plan Example

I’m sure you are an expert in devising a plan to address your debt situation now. But, before you go, just take a look at the following example and make sure your understanding is 100% correct.

Let us assume you have 5 outstanding debt. which commonly other Americans have, on your name

- Mortgage with outstanding $300,000 balance, a hypothetical $2,000 monthly payment at 4% APR.

- Auto loan with $40,000 balance, a $400 monthly payment and a 5% APR.

- First Credit Card with a $12,000 revolving balance, a $200 monthly payment at 20% Annual Percentage Rate

- Second Credit Card with a 8,000 revolving balance, a $150 monthly payment at 25% APR

- Third Credit Card with a $10,000 revolving balance and a $200 monthly payment and goes at 33% APR

The immediate first calculation that you shall do is sum up the debt payments you owe. In the above example, total debts come up to $2,950 per month.

Then, you decide how much additional amount you can pledge to tackling debt faster. For instance, you commit to put $4,000 in a month including the minimum payments to pay debt off fast.

But, you need to commit to not charging more expenses than you can repay on credit cards again. This will bring you out of the debt vicious cycle.

How To Start Tackling Debt Repayment Plan Faster?

By applying the efficient method of tackling debt, final debt repayment plan will look this way after you organize them.

- Third Credit card – 33% APR, minimum $200 monthly payment

- Second Credit card – 25% APR, minimum $150 monthly payment

- First Credit card – 20% APR, minimum $200 monthly payment

- Auto loan – 5% APR, minimum $400 monthly payment

- Home Mortgage – 4% APR, minimum $2,000 monthly payment

Every month, you commit to first get the minimum payment going on those debts from that $4,000 pool in total. You are now left with $1,050 to further spend on debts. You now go ahead and pay all of that $1,050 into third credit card and bring the outstanding balance down heavily.

After exactly nine months, you will see your third Credit Card missing from your debt list. Congrats! You paid your high interest debt off. You take out the third credit card entry from the top of debt repayment plan.

How To Continue Tackling Debt Repayment At The Same Pace After Closing First Debt?

So, now it just starts to look this way.

- Second Credit Card : 25% APR, minimum $150 monthly payment

- First Credit Card : 20% APR, minimum $200 monthly payment

- Auto loan: 5% APR, minimum $400 monthly payment

- Home Mortgage: 4% APR, minimum $2,000 monthly payment

Now, you have only $2,750 in minimum payments to make each month. Remember, we committed to not change the total payment towards debt $4,000 until all the debts are gone.

So, you currently have $1,250 for the extra payment towards debts, which according to our efficient method, now goes to Second Credit Card. You remove the second credit card once you pay it off in another few months and repeat the process.

After that, you start making large extra payments toward first Credit Card. Once you close this, you will left with only low interest debt, which you can close in a relaxed manner, if you want. But, I personally hate debt and will attack the debt in the same way we did to high interest debt and get them off the list.

By this way, you instill financial discipline in your life and get yourself an excellent credit score in the future. Wealth building starts from here.

Then, maybe you can go on a path to financial freedom and finally shape your life towards enjoying FIRE

Concluding thoughts

Working systematically to create a debt repayment plan will help you clear off the debts.

Create a monthly budget to cover your monthly necessities. Then, have realistic expectations on how much debt you can pay off each month. After that, consider one of the two common debt tackling strategies to create a comprehensive debt repayment plan (snowball vs avalanche method).

You can do everything with just pen and paper. But, I prefer digital format. Use the applications mentioned in this post (no affiliate) and help yourselves.

Work on your payment plan to pay off debt. You can also make use of the debt repayment plan calculator available online to get an idea of how much time it will take to close all the debts.

I personally love the avalanche debt method and will use that if I have debt. I closed my student debt a few years back real quick in a year using this strategy. You need to hate debt, if you want to emulate the same success.

So, plan NOW and eradicate the additional stress of paying off debt. Once you pay off debt, lead yourself in the right path of investing your excesses that went into debt before. Diversify, invest and build wealth. Then, start your travel towards financial freedom stage of your life.